The Minister of Finance, Dr Cassiel Ato Forson, has said that the Mahama administration is committed to fiscal discipline, especially as the government manages the Cedi.

As managers of the economy, he said, they have remained steadfast in their duty to ensure a strong and stable Cedi.

In a statement to mark the 60th anniversary launch of the Cedi, he said, “Our strong commitment to fiscal discipline has contributed to the strengthening of the currency. We remain committed, and we shall stay the course to ensure that the Cedi’s gains are maintained. As citizens, we have a role to play. We must maintain the sanctity of the Cedi as a legal tender, by preserving it with dignity and protecting it jealously. We must all be vanguards of its value by eschewing acts that seek to undermine its value, particularly the pricing of goods and services in foreign currencies.

“Let me use this opportunity to remind Ghanaians that the US dollar is not our currency. The continuous pricing of goods and services in US dollar will only hurt us. Let’s stop it! The Cedi is the only currency we have. Let us protect it. Let us trade with it. Let us defend it. Let us talk about it with pride, not as a burden, but as a badge of economic independence.”

Meanwhile, Member of Parliament for Ofoase Ayirebi, Kojo Opong Nkrumah, is questioning the sustainability of the appreciation of the Cedi against the major trading currencies, especially the Dollar.

He makes the point that the current appreciation, as witnessed by Ghanaians, is due to heavy market intervention by the government and the Bank of Ghana (BoG).

In October alone, he said, the BoG dumped about 1.3 billion dollars onto the market as part of efforts to appreciate the Cedi.

He wondered whether the appreciation would be sustainable if the central bank stopped the market intervention and allowed the normal forces of demand and supply to take place.

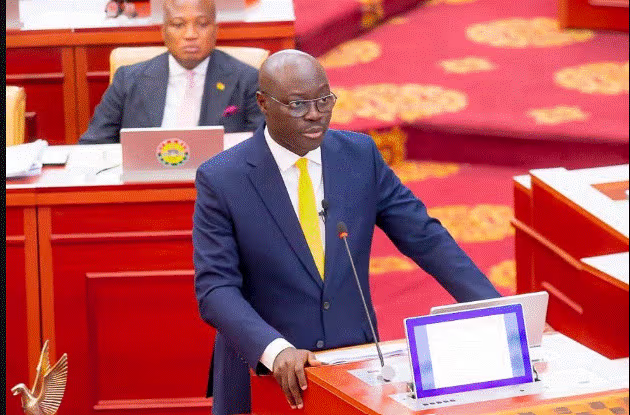

Reacting to the 60th anniversary launch of the Cedi, while speaking on the floor of parliament, Oppong Nkrumah said, “As we celebrate 60 years of the Ghana Cedi, to many Ghanaians, the most important question is, what is the value of the Cedi? What can it really buy?

“That brings to mind two specific questions: the question of inflation targeting and inflation management, and the exchange rate. Mr Speaker, if you have studied the economic history of our country, our cedi performs very well at some point in time and also very poorly at some point in time. Whenever a government has access to large volumes of forex reserves to do what they call market intervention, the Cedi is able to stand its ground against international currencies, and whenever we run short of hard currency, the depreciation gets very dire.

“I am happy to reiterate the comment made by the Minister for Education that the governor announced about 37.4 per cent appreciation of the Cedi year to date. The question is how? But I think the government has answered it already by saying that it is because they are doing market intervention. In fact, this month [October] alone, the BoG is dumping about 1.3billion Dollars onto the market, that’s the reason for the appreciation, so where are they getting these dollars from?”

He added that “Mr Speaker, it is because in 2021 a gold purchase programme was introduced for the first time in our history, aimed at enabling the state, through the BoG and the PMMC, buy gold and increase our gold reserves, that is why we moved from 8 tonnes to 30 tonnes. At that time, gold prices were averaging about 1,700 dollars per ounce.

“Today, gold prices are averaging about 4,000 dollars per ounce. So, because of this gold purchase programme, we are able to mobilise a lot of forex, and the central bank is now doing a lot of market intervention with the forex. Has anything strange happened? No. It is because of the conditions of the market and the introduction of the gold purchase programme that today we are able to mobilise a lot of forex through the BoG and the Godbod, which used to be PMMC, and this forex is now being dumped onto the market.”

“It begs the question that if you leave the market to the normal forces of the demand and supply of currency without the market intervention, will we get the 37.4% appreciation? Respectfully, I doubt,” he added.